Why We Built an Institutional-Grade Multifamily Model (And Documented Every Input)

Most templates online are either too simple to trust or too complex to audit. We wanted something better.

Most templates online are either too simple to trust or too complex to audit. We wanted something better.

Most multifamily models I see from clients fall into two camps.

Camp 1: The napkin math.

Annual NOI × cap rate. Maybe a growth assumption. No waterfall, no renovation timing, no monthly cash flows. It's fine for a first-pass gut check, but you can't present it to investors or take it to IC.

Camp 2: The black box.

Someone built something sophisticated three years ago. Now it's got broken links, circular refs, hardcodes buried in formula cells, and tabs nobody wants to touch. You spend more time auditing the model than underwriting the deal.

I spent a decade underwriting institutional deals, $40B+ across asset classes. The models I built were rigorous, auditable, and built for teams to hand back and forth without everything breaking. When I started Sapp Capital Advisors, I wanted to bring that same standard to our consulting practice.

So we built it. And then we documented the whole thing.

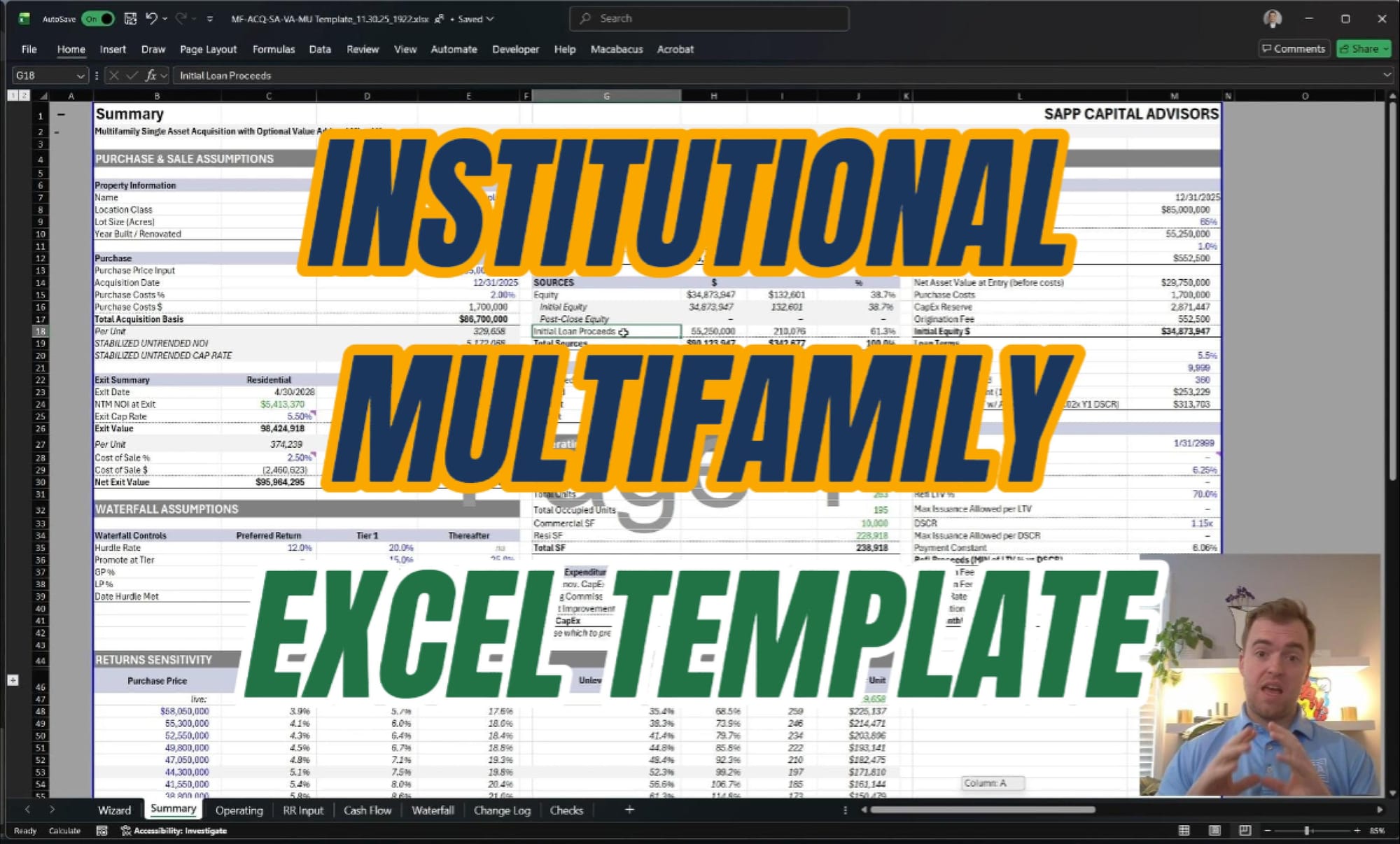

What's in the model

- Unit-level rent rolls with pre/post-renovation rent tracking by sub-unit type

- Value-add module with per-unit reno costs, timing, and rent premiums (toggles off cleanly for stabilized deals)

- Commercial mixed-use component with lease-by-lease detail, TI/LC, and annual steps (toggles off for pure residential)

- GP/LP waterfall with preferred return, tiered promotes, and catch-up

- Refinancing module constrained by both LTV and DSCR

- Error-check system that flags problems across every sheet

- Change log for version control

- Wizard sheet that walks through every input, line by line

Monthly cash flows. Print-ready summaries. No macros.

Why document it?

Two reasons.

First, we believe in showing our work. If you're evaluating consultants, you shouldn't have to guess whether they actually know what they're doing. This is how we think. This is how we build.

Second, these models aren't static. Every client engagement sharpens them; new edge cases, new deal structures, new ways to stress-test assumptions. The documentation reflects where we are today, but the practice keeps pushing forward.

What's next?

Retail and portfolio models are in the works. We're building this library based on what the market actually needs. So if there's a property type or deal structure you'd want to see, let us know.